Unlocking Bitcoin - Apr. 22, 2025

News on Bitcoin, tokenized financial networks and Sypher Capital

🟢 Sypher Capital News

Sypher Bitcoin Yield Fund

Since launch, Sypher Bitcoin Yield Fund has delivered 4% yields (paid in BTC) before fees and expenses, driven by our participation in Bitcoin Layer 2 protocols. We believe this lower-risk, yield-enhanced strategy represents the next evolution in Bitcoin-native capital allocation—generating returns without exposure to higher-risk centralized platforms, leverage, or exotic derivatives.

We are currently collecting capital for our upcoming close at the end of April. For accredited investors seeking institutional access to Bitcoin-native yield strategies, please reach out to ir@syphercapital.com for more information.

This communication is intended solely for accredited investors under Rule 506(c) of Regulation D. Past performance is not indicative of future results. This is not an offer to sell or a solicitation to buy securities. Any offering will be made only through official fund documents.

💎 Bitcoin News

Is Bitcoin Decoupling from Equities?

The past month has been turbulent for equities, as markets have struggled to digest the potential consequences of the new administration’s sweeping tariff strategy. Volatility spiked after President Trump’s April 2 announcement of reciprocal tariffs targeting dozens of countries based on trade imbalances—adding to an already aggressive posture on trade.

Then came April 4. China’s retaliatory response—a 34% tariff on all U.S. imports—sent shockwaves through the equity markets. Risk-off sentiment surged, the VIX jumped over 25%, and yet… Bitcoin ended the day in the green.

This caught our attention. We looked back at every instance since January 1, 2021, where the VIX rose by more than 25% in a single day. In all of the prior nine cases, Bitcoin traded flat or down. April 4 was the first clear exception.

While it’s just one datapoint, it raised an important question: could this be the beginning of a structural decoupling between Bitcoin and risk assets like the NASDAQ, with which it had shown a high correlation (R² ~0.70) as recently as late March?

At first, it looked like a head fake. In the days following April 4, Bitcoin's price action mirrored broader markets. But since April 9–11, we’ve seen a divergence: Bitcoin has begun to outperform equities—and more notably, it's behaving more like gold.

We’re still far from declaring that Bitcoin has officially been recognized as digital gold by global markets. But in a macro environment defined by fiscal stress, deglobalization, and trade rebalancing, Bitcoin’s resilience seems to be a meaningful development.

GameStop Just Doubled Down — Literally

In our last newsletter, we highlighted GameStop’s surprising move to adopt Bitcoin as a treasury reserve asset. Last week, CEO Ryan Cohen took things even further, pledging more than half of his $1 billion stake as collateral for a margin loan, per Bloomberg.

It's a bold move that signals serious conviction — not just in GameStop’s turnaround, but potentially in Bitcoin’s role as a strategic reserve asset. As we noted in The Bitcoin Tipping Point presentation, we expect corporate adoption to be one of the slowest drivers of Bitcoin demand, but if GameStop (and Ryan Cohen) find success in this strategy it may lead to other tech and tech-adjacent companies to take a more serious look.

🔓 Bitcoin Layer-2 News

Babylon Launches 'Genesis' Layer 1 to Advance Bitcoin Staking Platform

Babylon, a leading Bitcoin staking protocol, has launched its Layer 1 blockchain, "Genesis," marking a significant advancement in its BTC yield platform. Genesis aims to serve as a BTC staking network, utilizing staking and timestamping to harness Bitcoin's security while acting as a control plane to coordinate other networks that may stake Bitcoin. Since its inception in August last year, Babylon has attracted over 57,000 BTC (approximately $4.6 billion) in total value locked (TVL).

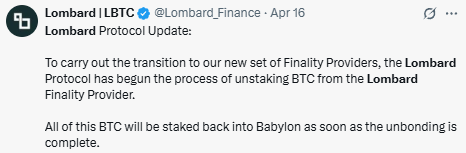

In a related development, Babylon experienced a 32% drop in TVL after $1.26 billion in BTC was unstaked, primarily due to Lombard Finance transitioning to a new set of finality providers. Lombard has indicated plans to restake the BTC once the unbonding process is complete.

As we prepare to stake our Bitcoin with Babylon, we view this as a strategic move to diversify our yield sources through an exciting opportunity without compromising custody.

🧐 Sypher Portfolio News

Circle: Files for IPO, Aiming to List Under 'CRCL' on NYSE

Circle, the issuer of the USDC stablecoin and a Sypher Capital portfolio company, has filed for an initial public offering with the SEC, aiming to list on the New York Stock Exchange under the ticker "CRCL." The company reported $1.7 billion in reserve income for 2024, accounting for over 99% of its total revenue.

Circle hired investment banks JPMorgan Chase and Citi to help with its IPO, initially valuing the company at $4 billion to $5 billion.

This move comes amid a more favorable regulatory environment and marks Circle's renewed effort to go public after a previously terminated SPAC merger in 2022.

Stablecoins Could Be the First Crypto Legislation to Hit the Floor

With both the GENIUS Act in the Senate and STABLE Act in the House, it appears that stablecoin legislation is more likely to hit the floor in 2025. Proponents believe stablecoins could generate “trillions of dollars of demand for US Treasuries”.

Standard Chartered believes the market could surge to $2 trillion by 2028. Even Fed Chair, Jerome Powell, has recently said he supports a regulatory framework around stablecoins.