Unlocking Bitcoin - Feb. 27, 2025

News on Bitcoin, tokenized financial networks and Sypher Capital

🟢 Sypher Capital News

Sypher Bitcoin Yield Fund Completes Cohort 2

Sypher Bitcoin Yield Fund received investment contributions for cohort 2 of its investment fund and successfully deployed the contributions into our yield-bearing strategy. Cohort 3 will likely occur in 1-2 months. Feel free to reach out to learn more.

Sypher Capital Partners Fund Letter

Sypher Capital Partners Fund sent its letter to investors this morning, but we thought we would share a snippet of our view of the current state of the economy.

A New Administration, A New Economic Gambit

No matter your political leanings, the administration’s worldview demands some adjustment in how we think. While both Biden and Trump have similar economic end goals (prosperity and self-sufficiency), their paths and approach diverge sharply. To use an analogy, if the economy is a car driving on the highway, Biden sought to pump the brakes occasionally while coasting to a manageable speed before re-accelerating. Trump, on the other hand, is attempting to throw the car into a lower gear before re-engaging.

This unconventional approach hinges on near-term economic pain with no clear historical playbook for success. Government spending is being slashed – significant, given it added roughly 1.2m jobs of the last 2 years, making it the country’s top hiring employer. Other cuts appear planned in the military, social security, various contracts, NGOs, research and education. To further emphasize the importance of this, full-time job losses in 2024 hit 900,000.

Tariffs are also intensifying, and consumers like you and I will foot the bill. We agree that tariffs are likely a negotiating tactic to get multinationals on-shore, but the immediate results could be higher costs paired with lower employment. Given that credit card debt is up 50% since 2020 and household debt is at a record $18 trillion, the setup doesn’t feel great.

The gambit, however, is that a bout of pain could help lower rates, kicking off a new growth phase with lower government spending/printing. Conventional wisdom ties lower rates to higher inflation, but it’s likely the heads in Washington are coming around to the view that baseline inflation is now higher than 2% and more like 3%. If we accept this, they key is growth in excess of inflation. That is, the absolute delta between growth and inflation is all that matters.

Trump wants rates lower. On Feb 12th, Trump said on CNBC that rates should be “lowered” to align with tariffs. Twelve days later, he reiterated that he wants rates to “drop immediately”. But as Powell’s term runs through May 2026, it seems difficult for Trump to get his wishes without forcing Powell’s hand on economy and jobs. Putting the moving car into a lower gear may just do that.

How this impacts the market is difficult to say as it seems more and more that market makers are frontrunning the frontrunners. In January, the market was not expecting significant rate cuts, but rate cut estimates are now rising. There are knock-on effects if rates do get cut. Foreign exchange is one and equity rotation is another. Both may impact funds flow over the next several months.

You can read the letter in its entirety here.

💎 Bitcoin News

Bitcoin Falls Below $90k…

On February 25th, Bitcoin fell below $90,000 for the first time since… 3 months ago (November 2024). Despite a number of positive political signals around bitcoin over the last few months, there are a number of recent events which have driven the drawdown, namely weaker than expected macro-economic datapoints (i.e., consumer confidence, manufacturing data, retail sales and Walmart guidance), intensifying tariff rhetoric, exhaustion from meme coins and a recent scare over the Bybit hack.

While there are valid concerns that the drawdown can continue without an obvious near term catalyst, we also note that these drawdowns are not atypical over the course of a cycle and that the long-term thesis around Bitcoin remains intact. Bitcoin remains a hedge against and is highly correlated (R2=0.70) to the growth of global money supply, which continues to grow.

1st Digital Assets Subcommittee Hearing Scheduled for Today (2/26)

Sen. Lummis (R-WY), a big supporter for Bitcoin and digital assets, chaired the first hearing for the newly established Digital Asset Subcommittee under the Senate Banking Committee. In her opening remarks, Lummis stated “We're on the precipice of finally creating a bipartisan legislative framework for both stablecoins and market structure. I hope to get both pieces of legislation to President Trump for his signature this year."

According to River, 52% of the Top 25 Hedge Funds & RIAs Own BTC

Citadel Plans to Expand into Crypto Trading

Bloomberg reported that Citadel, led by Ken Griffin, plans to expand into cryptocurrency trading, given the new administration’s pro-crypto stance. The firm was previously cautious due to the regulatory backdrop under the prior administration, but they now aim to be a market maker for centralized exchanges such as Coinbase, Binance and Crypto.com.

GameStop rises 18% on Reports It’s Considering Investing in Bitcoin

An article from CNBC reported that Gamestop (GME) was considering investing in “bitcoin and other cryptocurrencies", according to its sources. GME rose as much as 18% after-hours due to the report, but has since retraced most of the move. The company continues to focus on cost cuts and optimizing free cash flow in the face of declining revenue, but has $4.6 billion of cash and relatively minimal debt on its balance sheet. The company has tried to go expand into crypto and digital assets before, but has not found success.

🔓 Bitcoin Layer-2 News

Stacks Triples sBTC Capacity

Stacks tripled their BTC capacity to $300m in less than 24 hours. Sypher participated in the expansion and will receive yield paid in bitcoin from the protocol as part of its incentives program. We are excited about what is to come on Stacks, specifically its re-staking program, which the team is furiously working on.

🧐 Sypher Portfolio News

Circle: Tether Losing Market Share to Circle and Others

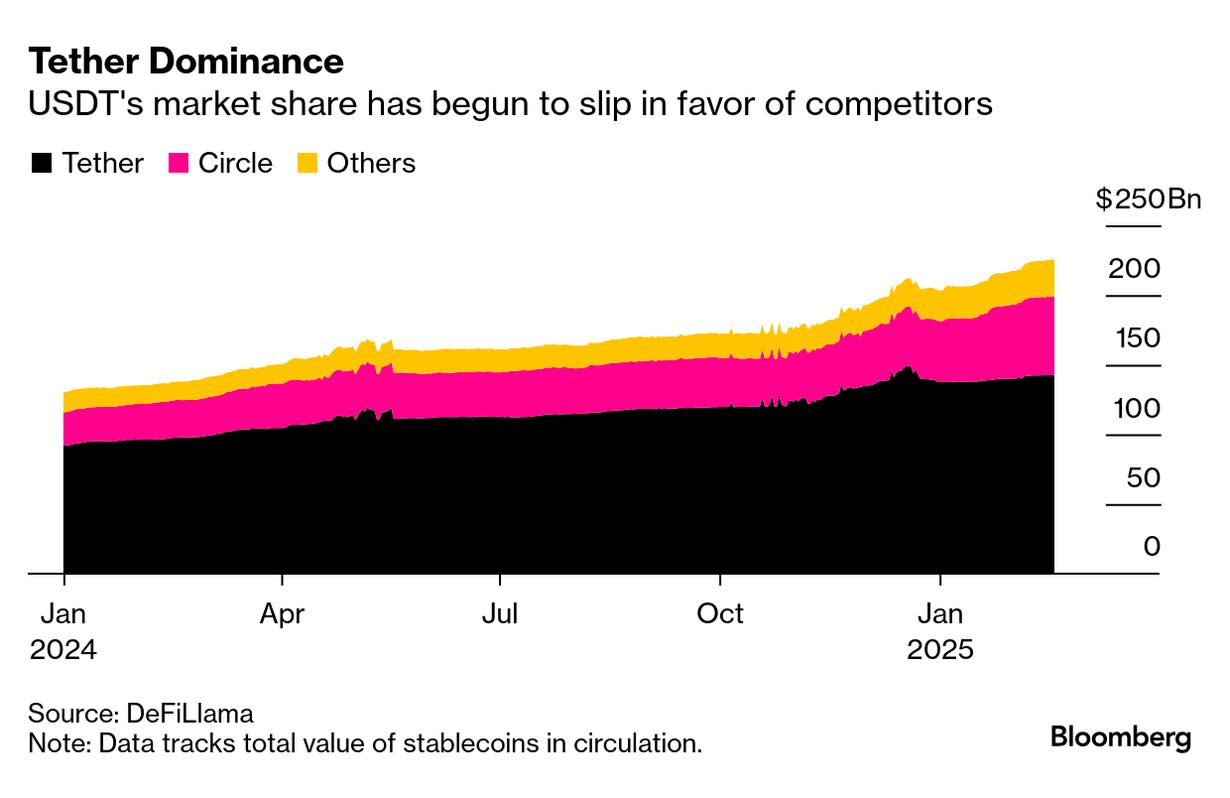

Tether ($USDT) has dominated stablecoins early, but that advantage has begun to slip. While USDT made up about 70% of the stablecoin market at the start of December, its share has steadily declined to around 63% as of mid-Feb, according to DeFiLlama data. The decline is partially due to new regulations in Europe, which requires crypto service providers to delist non-licensed tokens, which include $USDT. The EU now require issuers to hold an electronic-money license in at least one member state. It’s a complicated process which only a few have achieved so far, with Circle ($USDC) acquiring its license last summer. Tether has yet to secure the same permissions and has criticized the EU’s rules as being too onerous.

Some exchanges have opted to offer their own stablecoin in Europe to fill the void, while others, such as Coinbase and Binance, have leaned into $USDC as their preferred option through partnerships. Stablecoins have established themselves as one of the most profitable digital asset sub-sectors as issuers earn yield from managing reserves of assets backing their tokens, as Tether reported $13 billion in unaudited profit last year.