🟢 Sypher Capital News

Sypher Bitcoin Yield Fund Ready to Launch

Sypher Bitcoin Yield Fund recently completed its Private Placement Memo and is now taking initial subscriptions from Accredited Investors and Qualified Purchasers. If you would like to learn more, please email ir@syphercapital.com or feel free to reach out to us personally.

💎 Bitcoin News

Strategic Bitcoin Reserve?

There has been a significant amount of speculation around the potential for the United States to adopt a Strategic Bitcoin Reserve. Although some bitcoin owners were disappointed when President Trump revealed his executive order on digital assets/blockchain, as he ordered for the evaluation of a “digital asset stockpile” vs. a “bitcoin stockpile.” We disagree with that view as we would expect an executive order re: a crypto reserve to cover a broad base. In the end, if a crypto reserve becomes reality, we believe bitcoin will represent a large share.

Our view is enforced by recent comments from Sen. Lummis (R-WY), who is the first-ever Chair of the new Senate panel devoted to Digital Assets. Lummis reiterated the key point of her BITCOIN Act legislation, which she introduced in July 2024. The bill proposes a 1m BTC purchase program over 5 years (~5% of available BTC supply).

Speculation continued to increase after President Trump signed an executive order to start a sovereign wealth fund for the US government. Details were scant in the executive order, but that has not stopped crypto pundits from wondering whether this vehicle will include bitcoin and other digital assets.

We will save a more detailed view for 1v1 calls, but we believe once the first major developed country begins a bitcoin reserve in size, it has the potential to spark an accelerated “arms race” for BTC. Binance Co-Founder CZ recently stated, “Imagine being the last country to buy bitcoin.” We think to ourselves, “Imagine being the 3rd global superpower to buy bitcoin.”

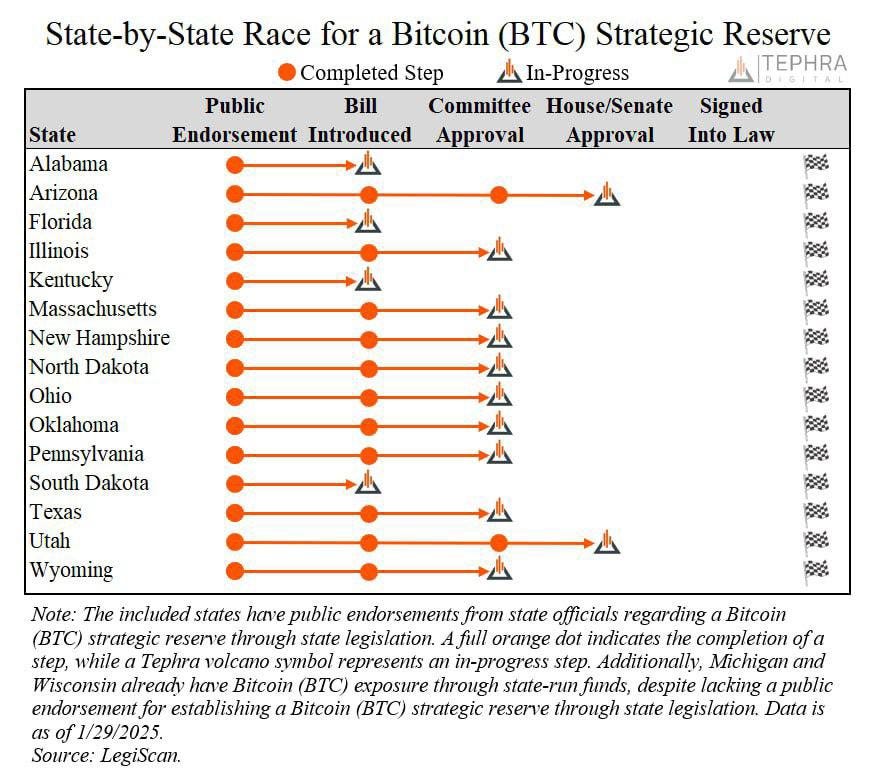

States Also Considering Strategic Bitcoin Reserve

15 19 states have introduced or are in the process of introducing bills related to their own Strategic Bitcoin Reserve. Utah and Arizona are furthest along in this process. Utah had its bill pass a House committee, and Arizona had its bill pass its State Senate Finance Committee.

ETFs Go On Crypto Filing Spree

Coinciding with the arrival of the Trump administration and a new SEC Chair, a number of ETF providers have filed ETFs for a wide range of new crypto ETFs which would have unlikely been approved under the prior administration. Additionally, several Bitcoin ETF providers (Blackrock, 21Shares, etc.) filed for in-kind creations and redemptions. We note that no ETF has solved the issue of providing private keys for their clients.

SEC Rescinds SAB 121

The SEC rescinds SAB 121, a rule introduced in March 2022 that requires financial institutions to record custodial digital assets as liabilities on their balance sheets. This move reinforces the significant shift in regulatory approach toward digital assets under Trump's administration. This move will remove a material barrier for banks to offer bitcoin and other crypto custody services.

🔒 Layer 2 News

Stacks Unveils Plans For Re-Staking

In an AMA with Korean stakeholders, the Founder of Stacks stated that Stacks has put re-staking on the roadmap. While we await for more details and timing, we are very bullish on the possibility to re-stake BTC in a decentralized manner to gain yield (potentially in BTC).

Babylon Reaches almost $6b in TVL

Babylon is a Layer 2 security protocol that leverages Bitcoin’s finality to re-stake other proof-of-stake (PoS) networks to enhance their security. Babylon is still in Phase-2 testnet, but has still managed to gain 80% of Bitcoin DeFi’s TVL. Even though they are only offering “points” as yield at the moment, we are closely monitoring their progress as a potential opportunity for the Sypher Bitcoin Yield Fund down the road.

🧐 Sypher Portfolio News

Circle: Trump’s Executive Order on Crypto Bans Central Bank Tokens

In his executive order on digital assets/blockchain, President Trump prohibits government CBDCs.

The Executive Order prohibits agencies from undertaking any action to establish, issue, or promote central bank digital currencies (CBDCs).

This de-risks a scenario where the US would issue its own stablecoins to compete with $USDC and $USDT. Instead, the executive order reinforces the potential for existing stablecoins, such as Circle’s $USDC, to continue to become further integrated with the traditional banking system in the US.

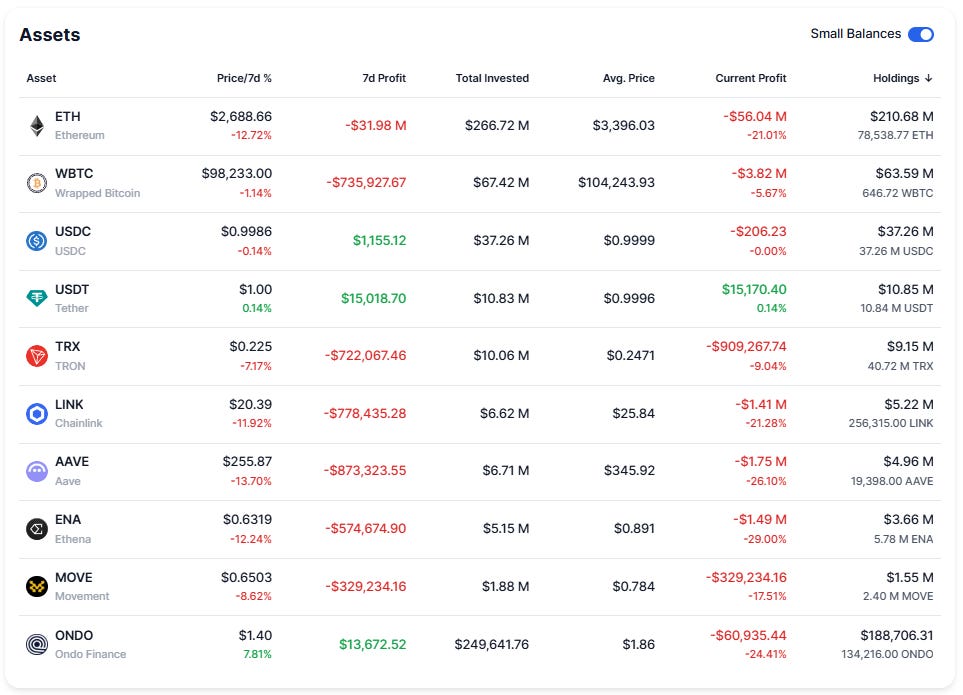

Circle: Trump’s World Liberty Financial Buys $USDC

World Liberty Financial (WLF) is a decentralized finance (DeFi) platform launched in September 2024 by former President Donald Trump and his family. In light of the executive order banning CBDCs, we found it bullish that WLF purchased Circle’s $USDC. We note that WLF owns ~3.5x more $USDC than $USDT, its biggest competitor in stablecoins.

Mighty Bear: GOAT Gaming Launching AI Agents to Play Games For You

Goat Gaming, created by the team behind Mighty Bear Games, is launching AlphaGOATS, which are AI agents that play games for you. GOAT Gaming has a platform for gaming on Telegram with over 5 million active users. The autonomous AI agents are designed to act as wealth engines, competing in tournaments, participating in prediction markets, and generating revenue for their owners around the clock.