Unlocking Bitcoin - June 26, 2025

News on Bitcoin, tokenized financial networks and Sypher Capital

🟢 Sypher Capital News

Join Us July 16 — Casual NYC Meetup for Sypher Investors & Friends

Sypher Bitcoin Yield Fund is hosting a casual get-together on Wednesday, July 16 in New York City for our investors and friends of the fund. If you’re interested in attending to meet the team and learn more about the fund, feel free to reach out to ir@syphercapital.com for details. We’d love to connect in person.

💎 Bitcoin News

From the Equity Strategist at Goldman Sachs this week…

“to repeat a stat from last week, BTC has rallied 42,020% over the past 10 years. the more time I spend with very senior clients, the more I realize that it has achieved genuine credibility (as a store of value) with those who have been-there-and-done-that.” - Tony Pasquariello

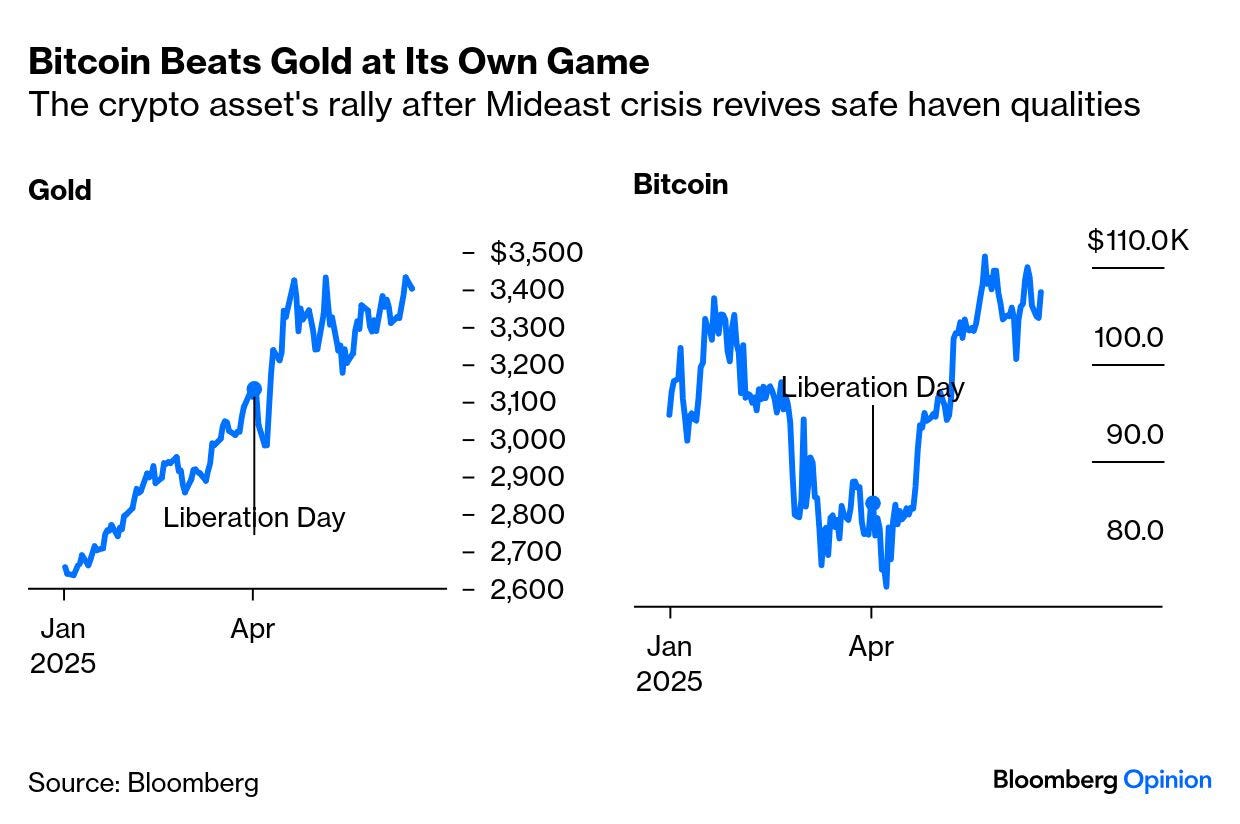

Is Bitcoin Showing Signs of Maturing as a Strategic Asset Amid Geopolitical Shocks?

In a recent note referenced by Bloomberg, FRNT Financial highlights how Bitcoin’s response to the latest Israel–Iran conflict marks a notable evolution in its market behavior. Whereas last April’s hostilities triggered a ~13% drawdown, this time BTC saw only a brief dip before rebounding nearly 5%, even as gold declined. The takeaway? Bitcoin may not yet be a traditional safe haven—but its reaction function is stabilizing. FRNT suggests this reflects growing institutional ownership, the influence of ETF flows, and a broader shift toward viewing BTC as a strategic macro asset. The idea that Bitcoin simply tracks speculative risk appetite may be outdated. It’s starting to hold up better in the moments that matter.

Senate Banking Releases Crypto Market Structure Framework — Principles, Not Policy (Yet)

On June 24, the Senate Banking Committee released a bipartisan set of “Market Structure Principles”—a high-level framework meant to guide future legislation around digital assets. While the document doesn’t yet express the committee’s policy positions, it lays out six foundational areas where lawmakers believe clearer rules are needed.

Here are the six principles they outlined:

Promote Responsible Innovation: Encourage crypto use cases while maintaining financial stability and fair competition.

Define Digital Assets and Their Treatment: Establish clear legal definitions for crypto assets and distinguish between securities, commodities, and other classifications.

Establish a Framework for Issuance: Create consistent rules for issuing digital assets, ensuring adequate disclosures and investor protections.

Oversee Intermediaries: Ensure centralized entities—like exchanges and custodians—follow clear licensing, registration, and risk management standards.

Safeguard Customer Assets: Implement protections to prevent mismanagement of user funds, including insolvency protections and segregation of assets.

Preserve Self-Custody and Transaction Freedom: Affirm the right to hold and transfer digital assets directly without relying on intermediaries.

While the document lacks specific legislative language, it signals the Senate’s intent to pursue a cohesive and bipartisan approach to crypto regulation—particularly around centralized actors and market infrastructure. We’ll continue monitoring for how this may evolve into formal proposals.

You can now use Bitcoin and crypto as collateral for a home mortgage!

Powell: Banks Can Serve Crypto

During his testimony before the House Financial Services Committee this week, Fed Chair Jerome Powell offered further clarity on the Fed’s position toward crypto, saying banks are free to serve crypto firms and engage in crypto activities—so long as they do so prudently. Powell’s remarks represent a continued shift in tone, reinforcing that there is no blanket prohibition against crypto banking relationships. As regulatory guidance evolves, statements like this help reduce uncertainty and may encourage more traditional institutions to cautiously reengage with the digital asset sector.

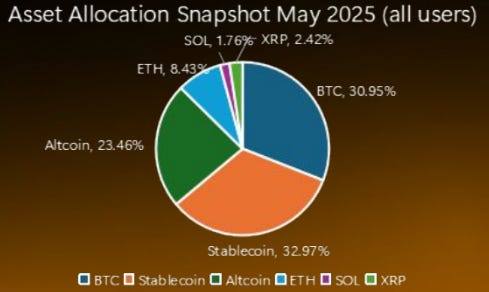

Bybit Report: Bitcoin Now Makes Up a Third of All Crypto Portfolios

According to Bybit’s latest investor report, Bitcoin has grown to 31% of all crypto portfolio allocations—up sharply from 25% in November 2024. The report, based on real trading data from tens of thousands of users, highlights Bitcoin’s continued dominance. While some of the change is due to the relative outperformance of Bitcoin over altcoins in recent months, we think this is a strong signal that capital continues consolidating around Bitcoin as the core holding for both institutional and retail portfolios.

Texas Becomes First U.S. State to Allocate Public Funds into Bitcoin Reserve

Texas has made history by becoming the first U.S. state to use taxpayer dollars to directly purchase Bitcoin, approving a $10 million Strategic Bitcoin Reserve under SB 21 and HB 4488. Unlike New Hampshire and Arizona—which passed enabling legislation but relied solely on non-tax revenues—Texas is placing real state capital behind Bitcoin, with funds held in cold storage for at least five years and managed independently of the general treasury. This bold commitment marks a turning point in crypto-friendly policymaking—shifting from theoretical frameworks to active fiscal deployment.

Pompliano’s ProCap Follows Twenty One in Growing Trend of Public Bitcoin Treasuries

Anthony Pompliano’s newly announced ProCap SPAC aims to raise $750 million to acquire and hold Bitcoin at scale—part of a broader trend of public market vehicles being purpose-built for Bitcoin accumulation. This follows the launch of Twenty One, which is set to go public with 42,000+ BTC on its balance sheet, making it the third-largest corporate Bitcoin holder globally. Together, these companies signal a new wave of Bitcoin-native public firms—structured not just to hold BTC, but to make it central to their financial strategy.

On a related note, Cointelegraph.com recently tweeted that over 100 companies now collectively hold more than 830,000 Bitcoin.

🔓 Bitcoin Layer-2 News

Stacks: SIP‑031 Vote Opens June 25 — We Recommend Voting YES

Voting for SIP‑031 will run from June 25 to July 9, starting at Bitcoin block 902,733. The proposal would establish a community-owned endowment funded by future STX emissions to support developer grants, infrastructure, and long-term growth of the Stacks ecosystem.

At Sypher, we recommend voting YES. SIP‑031 is a timely step toward decentralizing capital allocation and ensuring the network has the resources to scale sustainably—especially as institutional interest in Bitcoin yield continues to rise. STX holders can vote directly via standard wallets (both stacked and unstacked).

🧐 Sypher Portfolio News

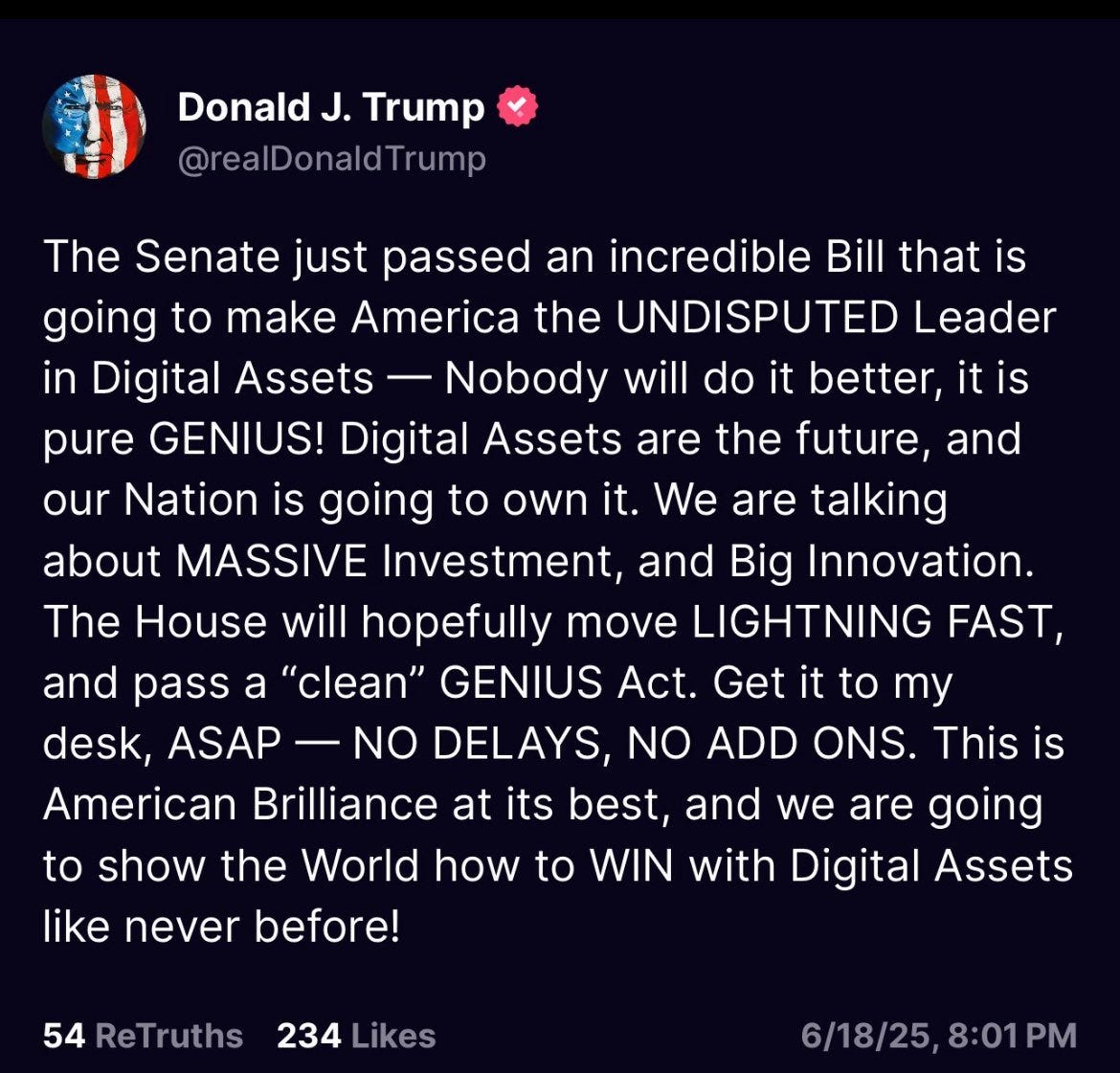

Circle: Senate Passes Landmark GENIUS Act — Trump Urges House to Move "Lightning Fast" and now moves to the House

In a decisive 68–30 bipartisan vote on June 17, the Senate approved the GENIUS Act—the first-ever federal stablecoin regulatory framework—establishing strict reserve backing, monthly disclosures, and consumer protections. The bill now heads to the House, which must pass it intact before President Trump signs it into law.

Meanwhile, Trump has urged the House GOP to act “LIGHTNING FAST”, demanding the Senate-approved version reach his desk “ASAP—no delays, no add-ons” to cement U.S. leadership in digital assets ahead of the August recess. This signals strong momentum behind stablecoin clarity and positions crypto as a core component of national financial strategy.

Chainlink: Partners with Mastercard to Bring DeFi to Real-World Payments

Chainlink and Mastercard have launched an on-chain fiat-to-crypto payment flow, integrating Uniswap, Zero Hash, and Mastercard’s network to bridge traditional finance with DeFi protocols. This collaboration enables direct crypto payments within Mastercard’s massive merchant ecosystem—merging real-time DeFi liquidity with everyday transactions. This marks a pivotal step in mainstream adoption, letting consumers and businesses alike tap decentralized finance's speed and transparency through familiar payment rails.