Unlocking Bitcoin - May 8, 2025

News on Bitcoin, tokenized financial networks and Sypher Capital

🟢 Sypher Capital News

Sypher Bitcoin Yield Fund May 15 Close Approaching

We’re wrapping up allocations for our next capital window, closing May 15. New and existing investors are participating, and we welcome interest from accredited investors seeking Bitcoin-native yield exposure. For details, please reach out to ir@syphercapital.com.

For accredited investors under Rule 506(c). Not an offer or solicitation.

💎 Bitcoin News

OP_RETURN Debate Heats Up! Wait, what is OP_RETURN?

A proposal gaining traction among Bitcoin Core contributors would remove the long-standing 80-byte limit on OP_RETURN—a function that lets users embed arbitrary data directly into Bitcoin transactions.

OP_RETURN is like sticking a "note" on the edge of a book page - you can write a few dozen words or a small piece of data into it. This note is marked as "read-only" by the system. Others cannot use it as money, and it will not have any impact on other "money" records in the ledger.

While not finalized, this change could have major implications for Bitcoin-native applications, particularly Layer 2 and DeFi protocols that rely on anchoring state or proofs to Bitcoin’s base layer.

Pros: Greater flexibility for Bitcoin-based protocols to store checkpoint data or cryptographic commitments directly on-chain, potentially reducing complexity and reliance on alternative storage methods. This could strengthen the security models of systems like Stacks, Babylon, and rollup-based approaches.

Cons: Critics warn that lifting the limit may invite spam, bloat the blockchain, and increase transaction fees—raising concerns about Bitcoin’s long-term scalability and purity as a monetary protocol.

The discussion reflects a broader tension: how much expressive power should Bitcoin’s base layer accommodate, especially as the Layer 2 ecosystem matures? That said, our initial view is that if the limits are lifted Layer-2 builders should get more design flexibility, better UX and enhanced security anchoring options.

New Hampshire and Arizona Embrace Bitcoin Strategic Reserves!

New Hampshire and Arizona have become the first states to establish strategic Bitcoin reserves. New Hampshire passed a law allowing up to 5% of its treasury to be allocated to BTC. Arizona, meanwhile, is launching a Bitcoin Reserve Fund seeded with unclaimed digital assets the state can legally claim and grow. While the combined potential allocations aren’t massive, the symbolism is significant: Bitcoin is being treated not as speculation, but as sovereign-grade reserve capital. We believe this marks the beginning of a broader trend toward Bitcoin normalization at both the state and federal level.

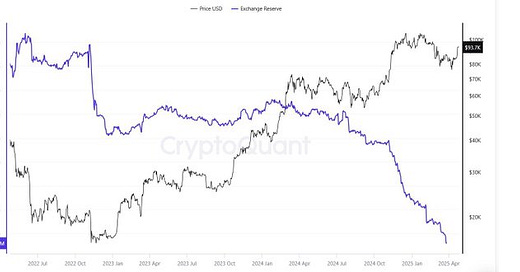

Bitcoin Exchange balances hitting 5 year low

Bitcoin exchange balances have plummeted to their lowest levels in years, signaling a strong accumulation trend among investors. Data from Glassnode indicates a 78% reduction in Bitcoin inflows to major exchanges like Binance and Coinbase over the past 30 days. This significant decrease in exchange inflows is a concrete indicator that selling pressure is diminishing, which historically precedes price surges.

Coincidentally, we have noticed that Coinbase has been gating withdrawals of BTC outside of their exchange over the last couple of months.

OCC Provides Clarity on Banks Holding Crypto

The Office of the Comptroller of the Currency (OCC) recently issued a letter that allows banks to provide digital asset services including custody and trading. Banks may outsource or internally develop the service and use sub-custodians to hold those assets. Banks can now do this as a part of normal operations

Wall Street’s New MicroStrategy? Twenty One Launches with $3.6B in Bitcoin

Twenty One, a Bitcoin-hungry firm backed by SoftBank, Cantor Fitzgerald, Tether, and Bitfinex, just saddled up with 42,000 BTC—putting it right behind MicroStrategy in the leaderboard of corporate holders. Led by Strike’s Jack Mallers and formed through a reverse merger, the group plans to raise billions more through bonds and equity to keep buying Bitcoin. Twenty One is clearly trying to market itself as a purer version of MicroStrategy.

🔓 Bitcoin Layer-2 News

Stacks Continues to Hit Milestones

Stacks is set to significantly expanded its sBTC capacity, increasing the deposit cap to 5,000 BTC on May 15, 2025. This move follows the rapid filling of previous caps—1,000 BTC in December 2024 and 3,000 BTC in February 2025. Additionally, sBTC withdrawals have been live for several weeks, enabling users to redeem their sBTC for native BTC on the Bitcoin mainnet. Thus far, withdrawals have been negligible, indicating users confidence and satisfaction with the protocol. These developments mark significant milestones for Stacks and in enhancing Bitcoin's utility within decentralized finance.

Sui Integrates sBTC and Stacks to Enhance Institutional-Grade BTCFi

Sui is set to integrate sBTC and will operate a validator on the Stacks network. This integration aims to unlock DeFi opportunities like lending, borrowing, and trading for BTC holders on Sui's blockchain. The move comes as Sui's total value locked (TVL) has surged by 50% in the past month, reaching $1.9 billion, with over 10% attributed to Bitcoin and Bitcoin-derived assets. This development positions Sui as a leading hub for institutional-grade Bitcoin decentralized finance.

🧐 Sypher Portfolio News

Circle: Bloomberg Reports $5B Offer from Ripple

According to Bloomberg, Ripple made a formal $5 billion offer to acquire Circle, the issuer of USDC and one of its main stablecoin rivals. The bid was reportedly rejected, with Circle believing it undervalued the company. This bid comes as Circle prepares for its IPO, targeting a valuation between $4 billion and $5 billion. Unverified rumors suggest Ripple might increase its offer to $20 billion, but no credible sources have confirmed this. The move highlights Ripple's ambition to expand its footprint in the stablecoin market and underscores the growing importance of stablecoins in the crypto ecosystem.

Circle: Banks are Coming to the Stablecoin party

The Federal Reserve has withdrawn prior guidance that required banks to seek advance approval for engaging in crypto and stablecoin activities, signaling a more permissive stance towards digital assets. This move aligns with similar actions by the FDIC and OCC, potentially opening the door for greater bank participation in the stablecoin market.

Concurrently, two major stablecoin bills—the GENIUS Act and the STABLE Act—are advancing in Congress. However, they are encountering resistance from Senate Democrats concerned about potential conflicts of interest, particularly involving President Trump's family's crypto ventures. This opposition has led to calls for stronger anti-money laundering provisions and restrictions on public officials' involvement in digital assets, casting uncertainty over the legislation's future.

🪙 Crypto News

New SEC Chair Signals Policy Pivot Toward Crypto Clarity

In his first public remarks, new SEC Chair Paul Atkins struck a markedly different tone on digital assets, calling for clear, fit-for-purpose regulation rather than enforcement-by-litigation. Speaking at a crypto roundtable, Atkins criticized prior approaches for stifling innovation and suggested the agency is preparing to ease its stance. His comments mark a potential turning point for how the SEC engages with the crypto industry.

Coinbase to Acquire Derabit, an Options Exchange

Coinbase has agreed to acquire Derabit, the world’s largest options exchange which facilitated over $1 trillion of transaction volume in 2024. Derabit is is a centralized cryptocurrency derivatives trading platform. It specializes in options and futures contracts for assets like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL), and is known for its high-volume, institutional-grade infrastructure. This acquisition is likely a nod toward anticipated regulatory clarity in the United States.